The Ontario Court of Appeal recently heard and dismissed an appeal of an interesting assessment law case in Craft Kingsmen Rail Corp. v. Municipal Property Assessment Corporation.

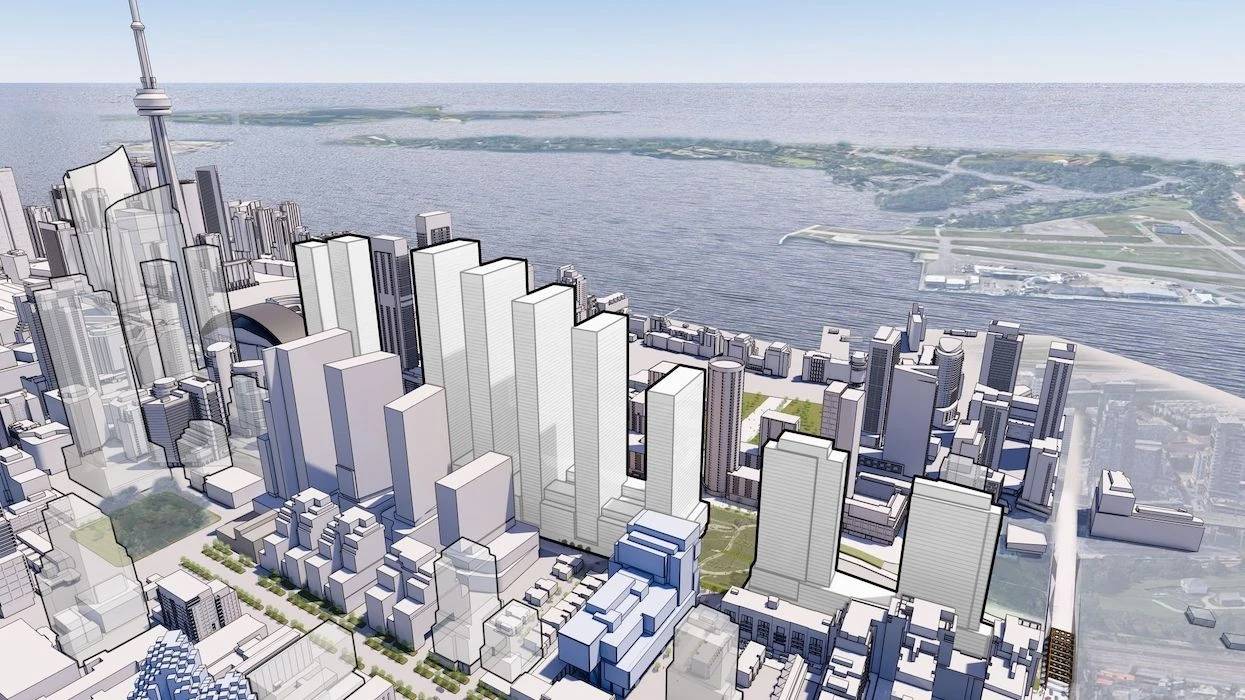

The issue involves air parcels that were purchased over the rail lines in downtown Toronto as part of a plan to develop the Rail Deck District. That is a plan to build a deck over the rail lines in the heart of downtown and build a series of residential apartment towers on that deck.

Craft Kingsmen bought the air rights over the rail line from CN Rail for $43,325,000. It then brought an application to Superior Court for a declaration that the air rights were not “land” as defined in the Assessment Act. That definition is:

Craft Kingsmen’s argument was that this definition points entirely to physical things and that air parcels are not captured under that definition. At Superior Court, Justice Myers agreed that the air parcels were not assessable in Craft Kingsmen Rail Corp v. Municipal Property Assessment Corporation. He was of the view that the definition of land in the Assessment Act does not include air parcels. Divisional Court had already, in 2011 in a leave decision, held that air rights are not land as defined in the Assessment Act, see Exchange Tower Limited v. Municipal Property Assessment Corporation, but that case did not directly address air parcels, only air rights.

The Divisional Court granted the appeal of Justice Myers’ decision in Toronto (City) v. Craft Kingsmen Rail Corp. Justice Charney sets out the “presumption of consistent expression” at paragraph 39 of the Divisional Court’s decision. This is a rule of statutory interpretation that states that when the legislature uses the same word in a number of different pieces of legislation, it generally will mean the same thing.

Relying on that principle, Justice Charney states, at paragraph 41, that “Interpreting the legislation so that air parcels are land for conveyance, registration, severance, and land transfer tax purposes, but not for assessment and taxation purposes, fails to interpret the legislative scheme regarding real property harmoniously as a comprehensive whole.”

Justice Charney then sets out why, in his view, Justice Myers was wrong to say that “we do not actually own the air above our heads.” Justice Charney cites a number of cases that say you do own the space above your land, but also notes that you cannot sue airplanes that fly over your land for trespass, see paragraph 47.

Next, Justice Charney sets out a history of the Ontario Assessment Act. He traces it back to 1869, noting that the older statutes taxed both real and personal property. The assessment of personal property ended with the 1904 amendment, which adopted the definition of “land” in the Assessment Act today. Justice Charney held that the 1904 expansion of the definition of land was intended to, and did, include some personal property.

That some “chattels” are assessable as “land” under the Assessment Act was confirmed by the Supreme Court of Canada in 1950 in Northern Broadcasting Co. v. District of Mountjoy, and by the Ontario Court of Appeal in 2008 in Carsons' Camp Limited v. Municipal Property Assessment Corporation.

But the case that Justice Charney relies on the most is the 1971 decision of the Supreme Court of Canda in Toronto Transit Commission v. City of Toronto. The issue there was the lease of air rights over the Davisville subway station by the TCC to a private developer. The lease was clear that they did not hold the ground rights. The City brought an application arguing that taxes were payable for the leased land. That case turned on the exemption in paragraph 3(1)9, which exempts municipal land except if the land is “occupied by a tenant who would be taxable if the tenant owned the land.”

In Toronto Transit Commission v. City of Toronto the developer had not constructed anything; it had only done some soil testing. The TCC argued that the land was therefore not occupied, so should still be exempt. The Supreme Court of Canda held that the land was occupied because it was leased, so was assessable. Justice Charney notes, at paragraph 86, that the “only real difference between the TTC case and the present case is that in the TTC case the air rights were leased, and the developer was a tenant or lessee. In the present case the air parcel was sold, and the developer is the new owner.”

As noted above, the Court of Appeal dismissed the appeal of the Divisional Court’s decision in very brief reasons. The Court of Appeal, in Craft Kingsmen Rail Corp. v. Municipal Property Assessment Corporation, simply stated that it agreed with the reasons of Divisional Court.

.png)